Board-Centric Contractarianism

Announcing new Bainbridge scholarship on the nature of the corporation

I’m contributing a chapter to a forthcoming multivolume work on corporations. Most of the chapters will be from a UK, Australia, Canada, and New Zealand perspective. But I was asked the chime in with a USA perspective on the nature of the corporation. My essay is now available at SSRN.

Bainbridge, Stephen Mark, Board-Centric Contractarianism (November 03, 2025). UCLA School of Law, Law-Econ Research Paper No. 25-07, Available at SSRN: https://ssrn.com/abstract=5700923 or http://dx.doi.org/10.2139/ssrn.5700923

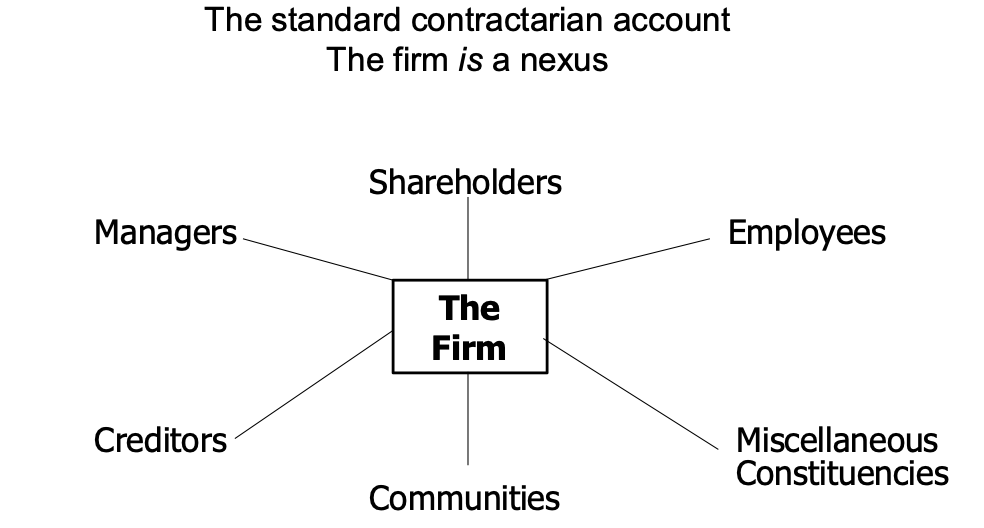

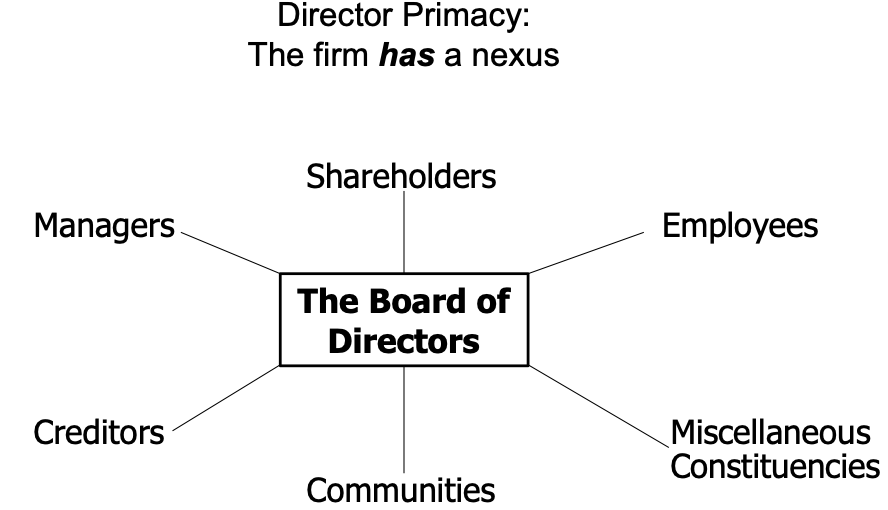

My chapter develops a comprehensive theory of board-centric contractarianism that reconciles the nexus of contracts model with the institutional reality of corporate governance. Although contractarian theory has dominated corporate law scholarship since the late twentieth century, it faces persistent conceptual challenges regarding the location of decision-making authority within a purely contractual framework. My chapter addresses this gap by positioning the board of directors as the Coasean nexus—the central coordinating mechanism that exercises fiat power while maintaining the voluntary nature of corporate relationships.

Drawing on transaction cost economics and agency theory, the chapter traces the evolution from traditional theories of the corporation (artificial entity, real entity, and aggregate theories) to modern contractarianism. It demonstrates that the defining characteristic of the firm is not merely its contractual nature but the existence of a central decision-maker empowered to adapt incomplete contracts through hierarchical authority. The analysis shows that shareholders and other corporate constituents rationally delegate decision-making authority to the board due to collective action problems, information asymmetries, and the benefits of specialized division of labor.

The board-centric approach resolves key criticisms of contractarian theory by acknowledging that corporate relationships operate through hybrid arrangements combining contractual and property-like features. By recognizing that implicit contracts within the corporation are inherently incomplete and legally unenforceable, the model explains why participants voluntarily submit to board authority while retaining exit rights. This framework provides both descriptive power for understanding existing governance arrangements and normative guidance for corporate law through the hypothetical bargain methodology.

The chapter concludes that board-centric contractarianism offers a coherent theoretical foundation for analyzing contemporary corporate governance challenges, from ESG considerations to evolving stakeholder expectations, while maintaining the efficiency advantages of the contractarian approach. Despite limitations inherent in rational actor assumptions and the hypothetical bargain methodology, this framework provides essential analytical tools for legal scholars and practitioners addressing fundamental questions of corporate purpose and regulatory design.