Corporate Law Backstories

Book recommendations

Having lived in Hollywood (Or, more precisely, the Hollywood Hills) for the last 27 years, I’ve gotten to know a fair number of people in the “industry.” One of the things I find fascinating is the way showrunners and writers develop backstories that never make it on air but nevertheless are a key part of the world building process.

When I teach corporate law classes, I often find myself wondering about the backstory of the cases we cover. Why did Meinhard and Salmon fall out? Why did the Dodge Brothers want to stop Ford Motor Co. from building the River Rouge complex? What were the interpersonal dynamics driving the Ringling family? And so on.

In my Business Associations class the other day, I mentioned the backstory to Dodge v. Ford Motor Co. and one student asked where she could learn about more backstories.

There are two great books chockfull of backstories to iconic corporate law cases, which I recommended to the student, and am passing along for anyone else who is interested.

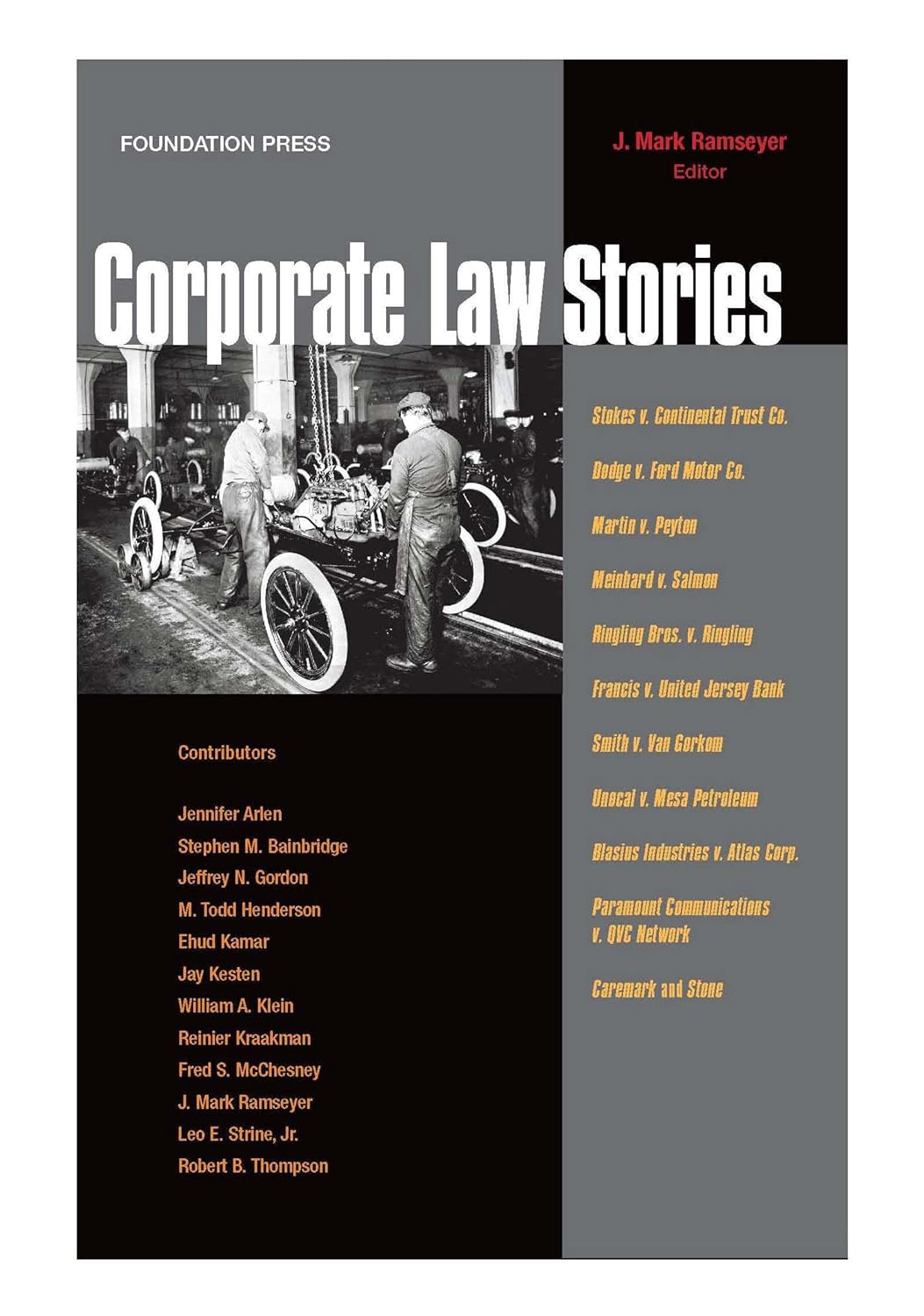

Corporate Law Stories edited by J. Mark Ramseyer

Using 11 pivotal cases that have shaped the evolution of corporate law, internationally renowned scholars explore the people behind the disputes and the forces that led the judges to decide the cases the way they did. From Meinhard v. Salmon to Paramount v. QVC, they unravel the logic (and, often, apparent illogic) of the opinions. Simultaneously amusing and clarifying, the resulting chapters make sense of cases that have puzzled students and scholars for decades.

My chapter is on Smith v. Van Gorkom, the classic Delaware case requiring that board of directors decisions are only protected by the business judgment rule if the decision was an informed one.

All of the chapters are quite good, but I’m especially enthusiastic about Todd Henderson’s chapter on Dodge, Bill Klein’s chapter on Martin v. Peyton, and Mark Ramseyer’s chapter on the Ringling Bros. case.

The Iconic Cases in Corporate Law edited by Jonathan Macey

“Iconic Cases in Corporate Law” gathers together in one book the most important (iconic) cases in U.S. corporate law. Each chapter features one case, or a pair or trilogy of closely related cases that represents the classic, representative and historically important cases in various areas of corporate law. These are the classic cases with which every student and practitioner of corporate law should be familiar. It seems appropriate that important research and new insights about these cases be brought together. Read from cover-to-cover the book provides a very useful introduction into U.S. corporate law. Each chapter also can be read individually in order to provide new insights, not only about particular cases but also about whole bodies of law including insider trading, shareholder voting, fiduciary duties and the business judgment rule.

My chapter is The Iconic Insider Trading Cases, which discusses the seminal SEC decision in Cady, Roberts, the classic Texas Gulf Sulphur decision, and the three critical Supreme Court decisions in Chiarella, Dirks, and O’Hagan.

There is some overlap between the two books, but each book offers unique perspectives. Both are worth owning if this is your field of interest.