Is Anyone Worth $1,000,000,000,000?

Commentary from around the web on Tesla shareholders' approval of Elon Musk's pay package

From Francis Pileggi’s Delaware Corporate & Commercial Law Monitor:

Had Tesla remained in Delaware, we might expect the new pay package’s approval would trigger a wave of litigation, as was the case when TSLA shareholders approved Musk’s 2018 pay package. However, Tesla recently relocated its corporate domicile to Texas from Delaware, and any subsequent shareholder litigation must be resolved in Texas under the state’s newly adopted shareholder governance regime. One massive obstacle is that Texas’s new management-friendly rules give Tesla the ability to block lawsuits unless filed by shareholders holding at least 3% of the stock (approximately $45B at TSLA’s current valuation). Only three shareholders, besides Musk, hold more than three percent of TSLA: Vanguard, BlackRock, and State Street.

“They are completely insulated from a shareholder lawsuit in Texas,” said Ann Lipton, a professor at the University of Colorado Law School.

Speaking of Ann Lipton, an excerpt from a post you ought to read in full:

“Schwab Asset Management earlier this week pledged to back the pay proposal after a number of prominent retail shareholders said on social media that they would move funds out of brokerages that voted in opposition.”

With the caveat that I am not exactly clear on what assets were involved, this is an interesting conundrum of fiduciary obligation and mutual fund voting.

On the one hand, shouldn’t funds vote the way the investors want? On the other, Tesla stans are not the only investors in the fund, and if Schwab believes the pay package is bad for the fund overall, shouldn’t those other investors be protected?

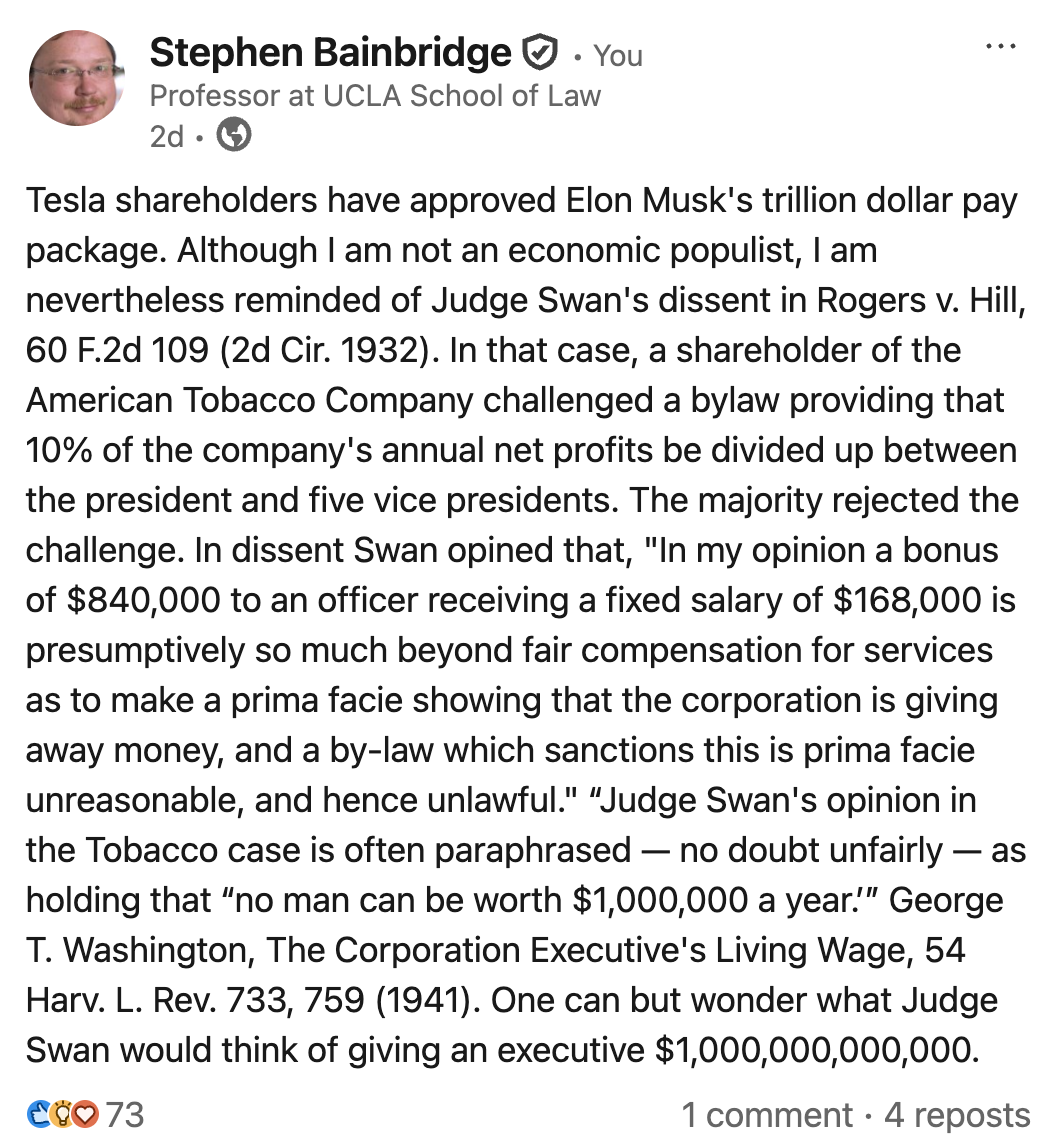

Yours truly on LinkedIn: