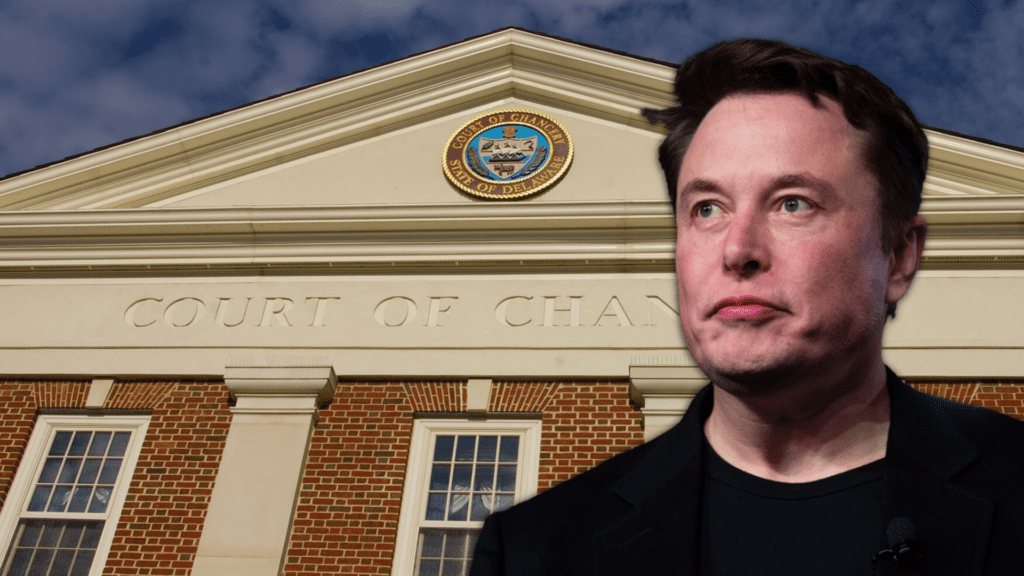

The Delaware Supreme Court Heard Oral Argument in Elon Musk’s Compensation Case

At long last, Tornetta v. Musk winds to its final conclusion

The Delaware Supreme Court today heard oral arguments in In re Tesla Derivative Litigation (a.k.a. Tornetta v. Musk), the long-pending shareholder suit challenging Elon Musk’s 2018 CEO pay package.

The Delaware Court of Chancery’s decision in the Tesla derivative litigation sent shockwaves through corporate America, and for good reason. Two aspects of the court’s rulings are particularly problematic: the adoption of an unprecedented “Superstar CEO” doctrine to find controlling stockholder status, and the rejection of a fully informed post-trial stockholder ratification. Both decisions represent significant departures from established Delaware law and threaten to undermine the principles of stockholder primacy and private ordering that have long made Delaware the preferred jurisdiction for incorporation.

I’ve touched on both issues in prior posts:

But the Supreme Court’s argument seems like an appropriate occasion to revisit these issues and expand on our earlier coverage.

Keep reading with a 7-day free trial

Subscribe to Bainbridge on Corporations to keep reading this post and get 7 days of free access to the full post archives.