Shareholder Activism in Closed-End Funds: An Empirical Analysis

Implications of Restrepo's findings for FS Credit Opportunities Corp. v. Saba Capital Master Fund, Ltd.

On December 10, the US Supreme Court heard oral argument in FS Credit Opportunities Corp. v. Saba Capital Master Fund, Ltd. The case involves a circuit spliton the question of whether there is an implied right of action under § 47(b) of the Investment Company Act of 1940 (ICA) pursuant to which parties to a contract that violates the ICA may seek rescission of the contract. Granted, compared to most of the cases on the Supreme Court’s docket, this seems a minor issue but it actually has considerable commercial importance.

SCOTUSblog explains:

The statute imposes various safeguards on investment companies, generally designed to protect third-party investors from self-dealing conduct at the hands of insiders of the investment companies. …

The particular provision in question, Section 47(b), authorizes courts to rescind any contract that violates any of the specific provisions of the statute. …

The fund (FS Credit Opportunities Corp.) characterizes the lower court decision as emblematic of the “ancien regime” that the justices have been criticizing for the last few decades, in which the court frequently implied private rights of action, especially in cases involving securities litigation. As so many of the court’s opinions have emphasized in recent years, that regime is now a distant memory. Because the statute does not contain the kind of language that creates a private right of action – identifying particular plaintiffs and authorizing them to bring a suit for some specified reason – the fund argues that there is no basis in the court’s modern jurisprudence for what the lower courts have done here. That result is particularly appropriate in this case, the fund says, because the statute does include two explicitly crafted private rights of action, neither of which would apply to this dispute.

The investors (including Saba Capital Master Fund) rest their case on the court’s 1979 decision in Transamerica Mortgage Advisors v. Lewis. A closely divided court in that case recognized a limited private right of action to rescind unlawful contracts, based on a provision of the Investment Advisers Act that closely resembles the provision at issue here. For the investors, there is no basis for treating this statute any differently than the provision at issue in Transamerica.

SCOTUSblog reports that the oral argument appeared to favor Saba Capital:

Yesterday’s argument in FS Credit Opportunities Corp. v Saba Capital Master Fund showed a bench surprisingly receptive of private parties having the ability to sue investment companies under the Investment Company Act of 1940. Although the justices have been skeptical of implied rights of action in recent decades, most of them seemed to think that the statute went far enough to authorize the limited relief sought in the case before them, namely the right to invalidate a contract inconsistent with the statute. …

Also seeming to favor relief, Justice Elena Kagan looked to the 1979 decision in Transamerica Mortgage Advisors v. Lewis – which recognized a similar cause of action in a companion statute to the Investment Company Act. Kagan commented to the government’s lawyer Max Schulman: “you would really have us … look at these two companion pieces of legislation passed at the same time and say that the exact same language has one result in one statute and the other result in another statute just because there happens to be in one of the statutes private rights of action for damages that are essentially unrelated. … That seems like a pretty extreme position, honestly.”

In an earlier case, Oxford University Bank v. Lansuppe Feeder, LLC,1 the Second Circuit Court of Appeals had held that:

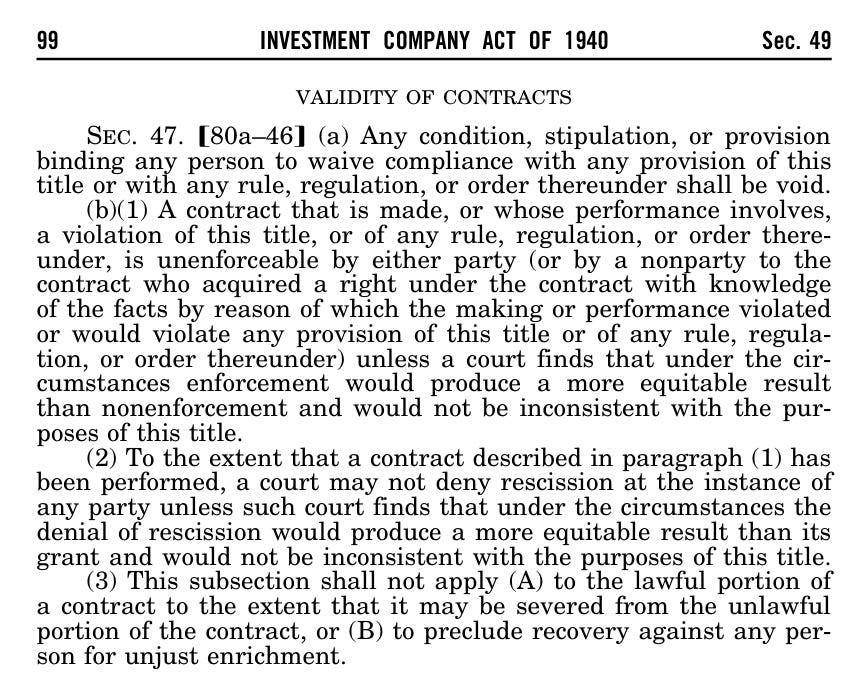

The text of § 47(b) unambiguously evinces Congressional intent to authorize a private action. Both subsections of § 47(b) indicate that a party to an illegal contract may seek relief in court on the basis of the illegality of the contract. Section 47(b)(1) renders contracts that violate the ICA “unenforceable by either party” to the violative contract, meaning at least that a party sued for failure to perform under such a contract may invoke the illegality of the contract as a defense. Section 47(b)(2), the provision on which Intervenors rely, provides that “a court may not deny rescission at the instance of any party ....” Although Congress did not expressly state that a party to an illegal contract may sue to rescind it, the clause that begins “a court may not deny rescission at the instance of any party” necessarily presupposes that a party may seek rescission in court by filing suit. The language Congress used is thus effectively equivalent to providing an express cause of action.2

All of which seems pretty persuasive. Yet, some commentators have pointed out that the OUB decision has had a significant unintended consequence:

The plaintiffs’ bar has taken advantage of the Second Circuit’s favorable case law by filing complaints in district courts within that circuit asserting causes of action premised on Section 47(b) and alleging violations of other sections of the 1940 Act. And, although Section 47(b) by its terms applies only to the rescission of contracts, plaintiffs have attempted to bring actions under Section 47(b) in various contexts outside of typical contract disputes, such as purchases of securities and challenges to fund by-laws. Most notably, closed-end fund activist investors have used Section 47(b) as a vehicle to challenge anti-takeover measures adopted by closed-end fund boards. FS Credit Opportunities, the case in which the Supreme Court has now granted certiorari, is a prominent example of that use of Section 47(b).

In FS Credit Opportunities, an activist hedge fund used Section 47(b) to challenge anti-takeover measures adopted by several closed-end funds organized under Maryland law. Each fund’s board of directors had adopted a resolution opting into the Maryland Control Share Acquisition Act, which limits the voting rights of shares obtained by a controlling shareholder over a certain threshold. The activist hedge fund sought to have those board resolutions rescinded so that the activist could take a controlling interest in the funds. The activist contended that the board resolutions violated Section 18(i) of the 1940 Act, which generally requires that each share of a registered fund “have equal voting rights.” 15 U.S.C. § 80a-18(i). Since Section 18(i) does not itself provide for a private right of action, the activist filed its action in the U.S. District Court for the Southern District of New York (which is within the Second Circuit and therefore bound by Second Circuit precedent) and asserted a cause of action under Section 47(b). Although Section 47(b) permits rescission only of contracts, the activist’s theory was that the board resolutions affected the contractual relationship between each fund and its shareholders. The closed-end funds argued that Section 47(b) did not provide a private right of action and that the board resolutions did not violate Section 18(i).3

FS Credit alluded to this point in its briefing:

Saba describes itself as an activist investor. It invests in closed-end funds whose shares are trading at a discount compared to the funds’ NAV. Then, after taking steps to initiate actions to inflate the share price, like a liquidity event, it sells its shares, thus earning a short-term profit, typically at the expense of ordinary long-term investors. …

These abusive tactics conflict with the interests of ordinary shareholders. Take self-tenders, for instance. A fund needs cash to satisfy a self-tender offer. But closed-end funds, by design, generally carry significantly less cash on hand. Instead, they increase their potential for long-term returns by fully investing their assets-something they can do because, unlike openend funds, they do not redeem shares daily “at the option of the shareholder.” Moreover, closed-end funds are not required to maintain any amount of highly liquid assets, again unlike open-end funds. Thus, if a closed-end fund is forced to satisfy a large self-tender, it must sell portfolio holdings-even, if necessary, at a loss (particularly when the holdings are not liquid). The consequences are a decreased asset base, reduction in leverage, and potentially unfavorable tax consequences-“all to the detriment of the fund’s returns and distributable income.” With short-term concentrated investors cashing out, it’s ordinary shareholders who suffer.4

So one question that, at the very least, will lurk in the background as the Supreme Court ponders this case is whether recognizing an implied right of action “would result in a significant increase in shareholder activism against closed-end funds (CEFs) and a sharp decline in the number of funds available in the market.”

My friend and UCLAW colleague Fernan Restrepo posed that question in a recent paper, which conducted an empirical study of whether OUP triggered an increase in shareholder activism or a decrease in the number of closed-end funds.

Keep reading with a 7-day free trial

Subscribe to Bainbridge on Corporations to keep reading this post and get 7 days of free access to the full post archives.